Phat Low Volume Setups

Monday12/15/25

AAPL

Trend: Uptrend; price (~279) is above rising 20‑day (~276), 50‑day (~268), and 200‑day (~229) moving averages, with RSI in the high‑50s (neutral‑bullish).

Support/Resistance (1–4 weeks): Support ~270–275 near recent swing lows and the 20‑day; resistance ~288–290 around recent highs.

Setup type: Gentle pullback/base under highs with tight daily ranges and low ATR (~1.7–1.8% of price).

Catalysts: On‑device AI, services growth, and hardware refresh; next earnings anticipated late January, outside 3 weeks.

MDGL

Trend: Strong multi‑month uptrend but recently paused; price (~555) remains above rising 50‑ and 200‑day MAs while momentum has cooled, with RSI near neutral.

Support/Resistance: Support ~540–550 around the recent pullback lows and near short‑term support; resistance ~590–605 near recent highs.

Setup type: Pullback‑to‑support after a big run; daily ranges are larger (ATR ~4–5% of price), so it is a higher‑beta biotech swing.

Catalysts: NASH/metabolic disease pipeline with recent regulatory and clinical progress; major dated catalysts and earnings appear beyond the next 3 weeks.

HCA

Trend: Strong uptrend; price (~486) is above rising 20‑, 50‑, and 200‑day MAs (20‑day ~416–486 zone, 50‑day ~419, 200‑day ~367) with RS in the mid‑60s to 80s.

Support/Resistance: Support ~460–465 near the 50‑day and recent lows; resistance ~500–520 at the recent high band.

Setup type: Pullback‑then‑rebound from the 50‑day; ATR ~2–2.5% of price, so volatility is moderate and controlled.

Catalysts: Hospital operator with strong EPS and ROE; next earnings generally late January, so no scheduled event in the next 3 weeks.

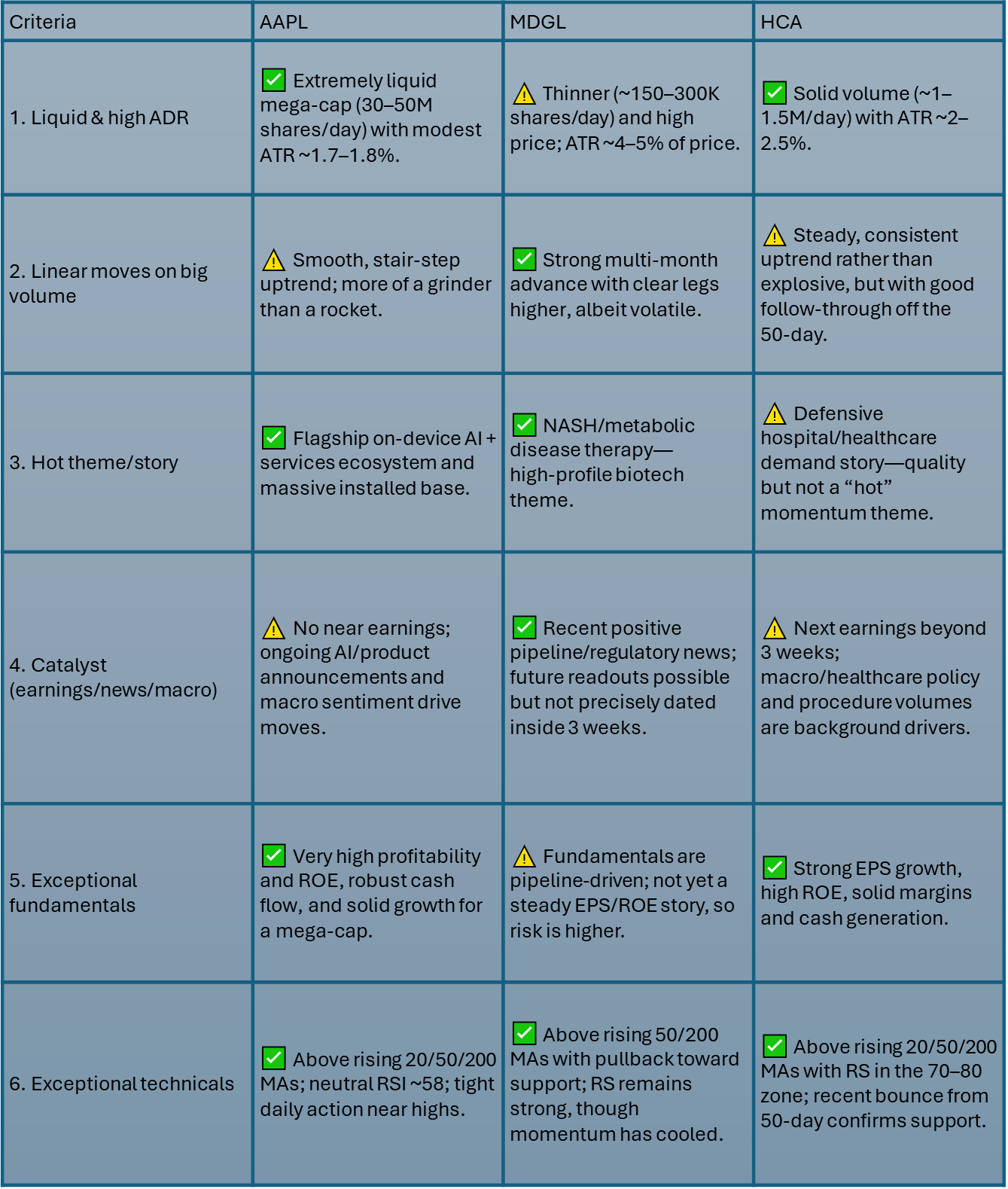

6‑Point Scorecard

Top Setups Tonight

AAPL – Highly liquid, steady uptrend above rising 20/50/200 MAs, tight consolidation just below highs, and a durable AI/services story; ideal for a lower‑vol 3–15 day swing.

HCA – Strong, defensive healthcare leader bouncing from the 50‑day with excellent fundamentals and a clear support/resistance map; great if you want a calm, institutional‑quality swing.

MDGL – High‑RS biotech in a constructive pullback after a big run, tied to a hot NASH theme; offers the most upside but also the most volatility and position‑sizing risk.